Why Fresh Start Finance?

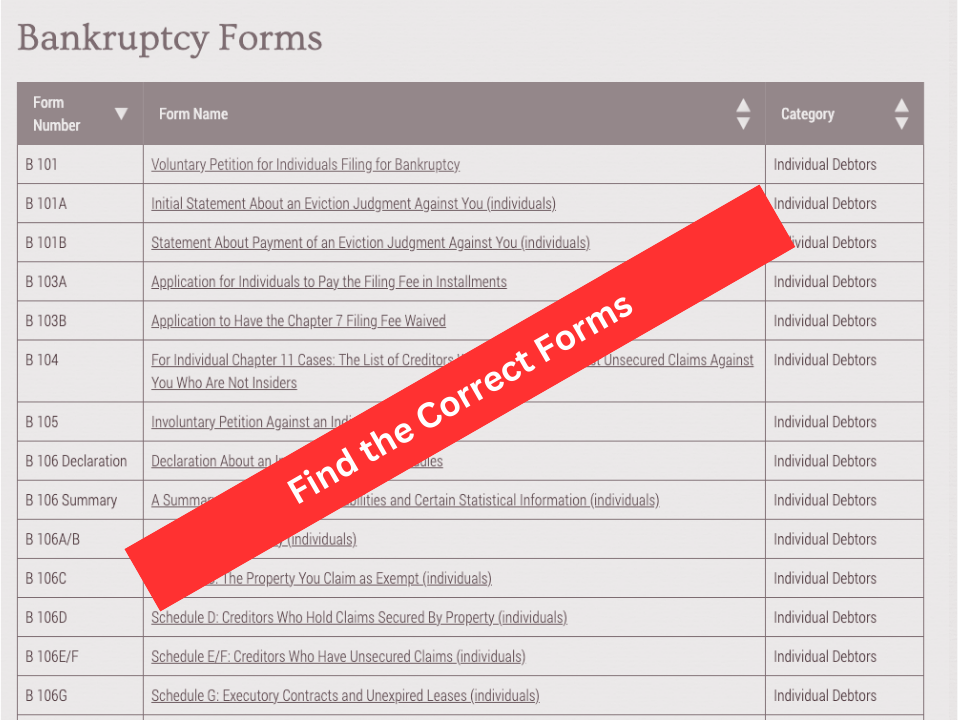

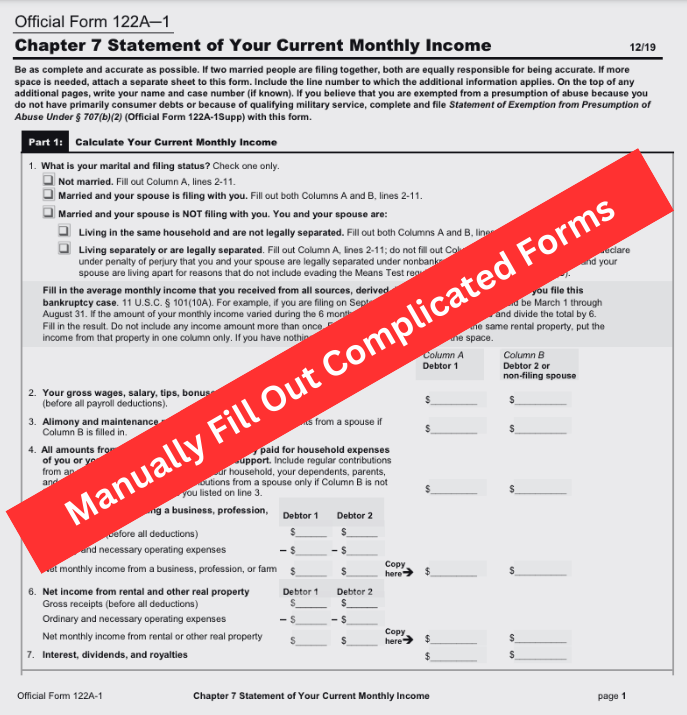

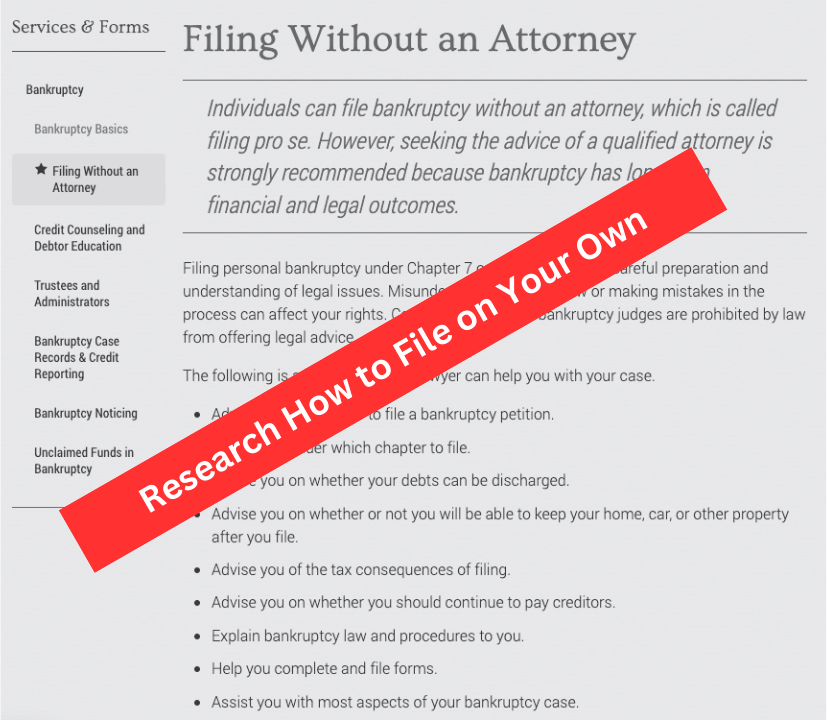

Our mission is to provide an affordable, easy-to-use bankruptcy software that simplifies the self-filing process, helping individuals take control of their financial future without the need for an attorney.

Take a short questionnaire to see whether the Fresh Start Finance bankruptcy filing software may meet your needs.

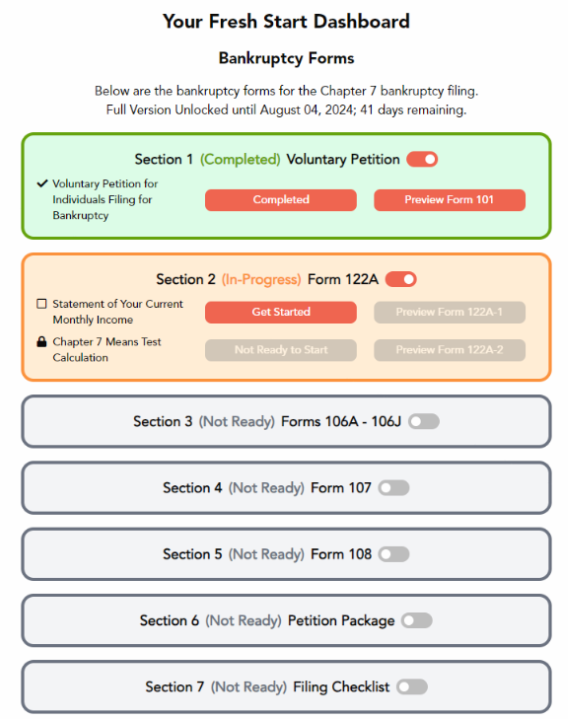

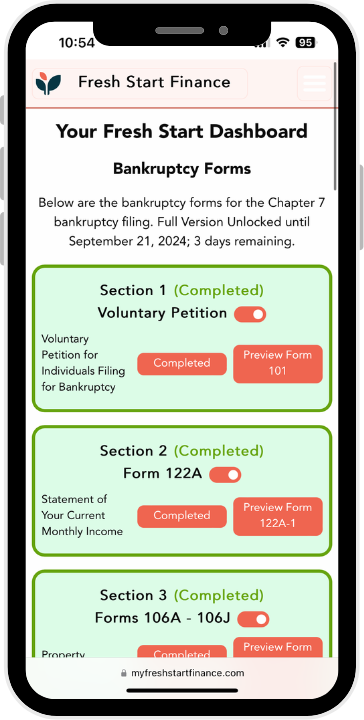

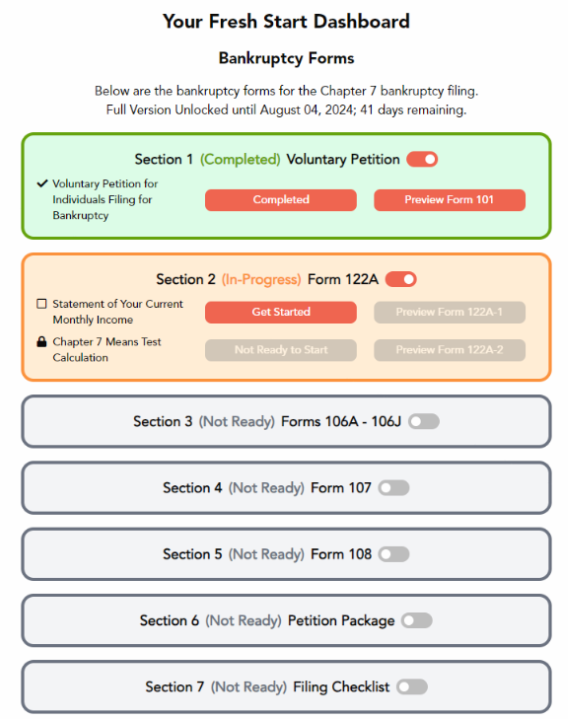

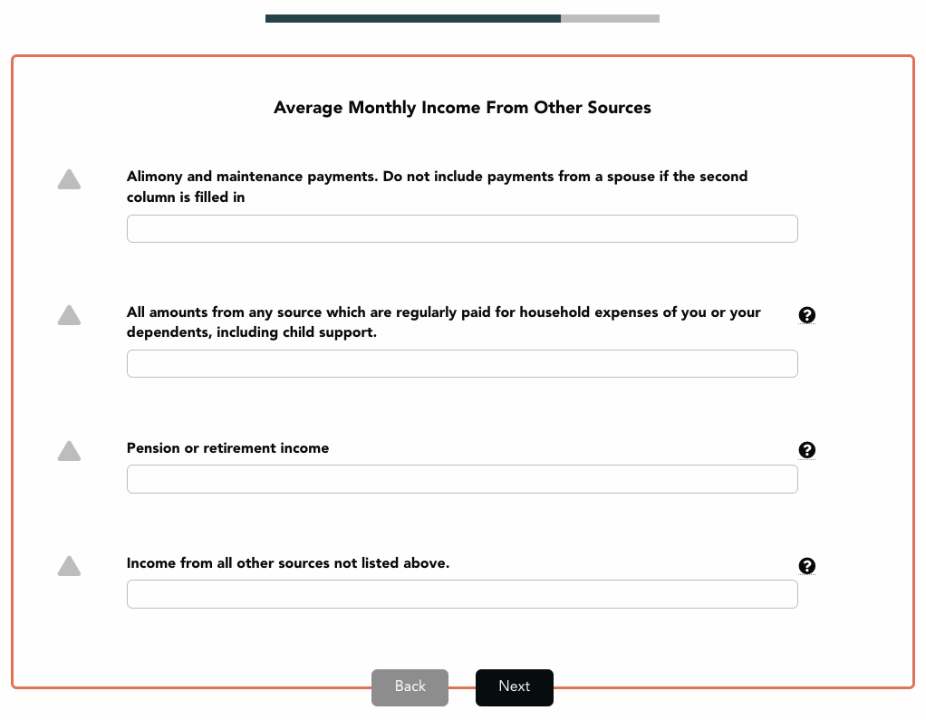

We've created user-friendly software designed to save you time. Try it for free before deciding to buy.

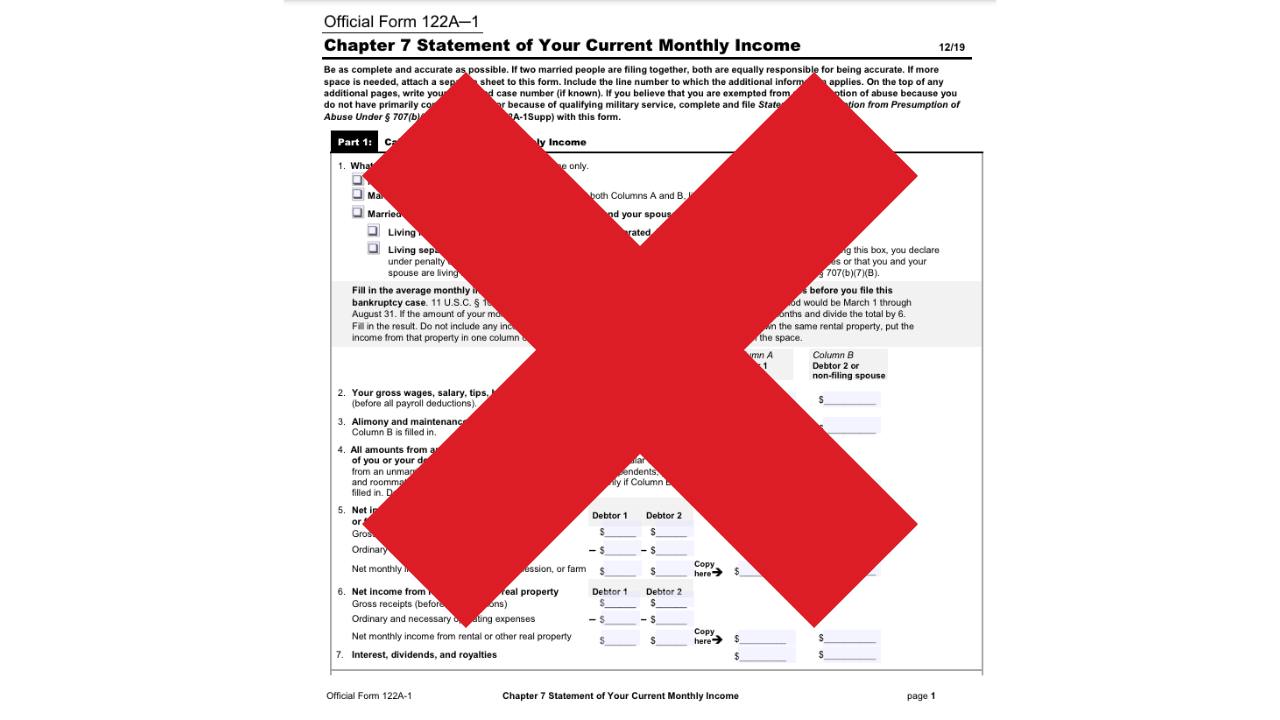

Once you've tested the product and found it helpful, you only need to pay a one-time fee to unlock full access, allowing you to complete the bankruptcy forms effortlessly.

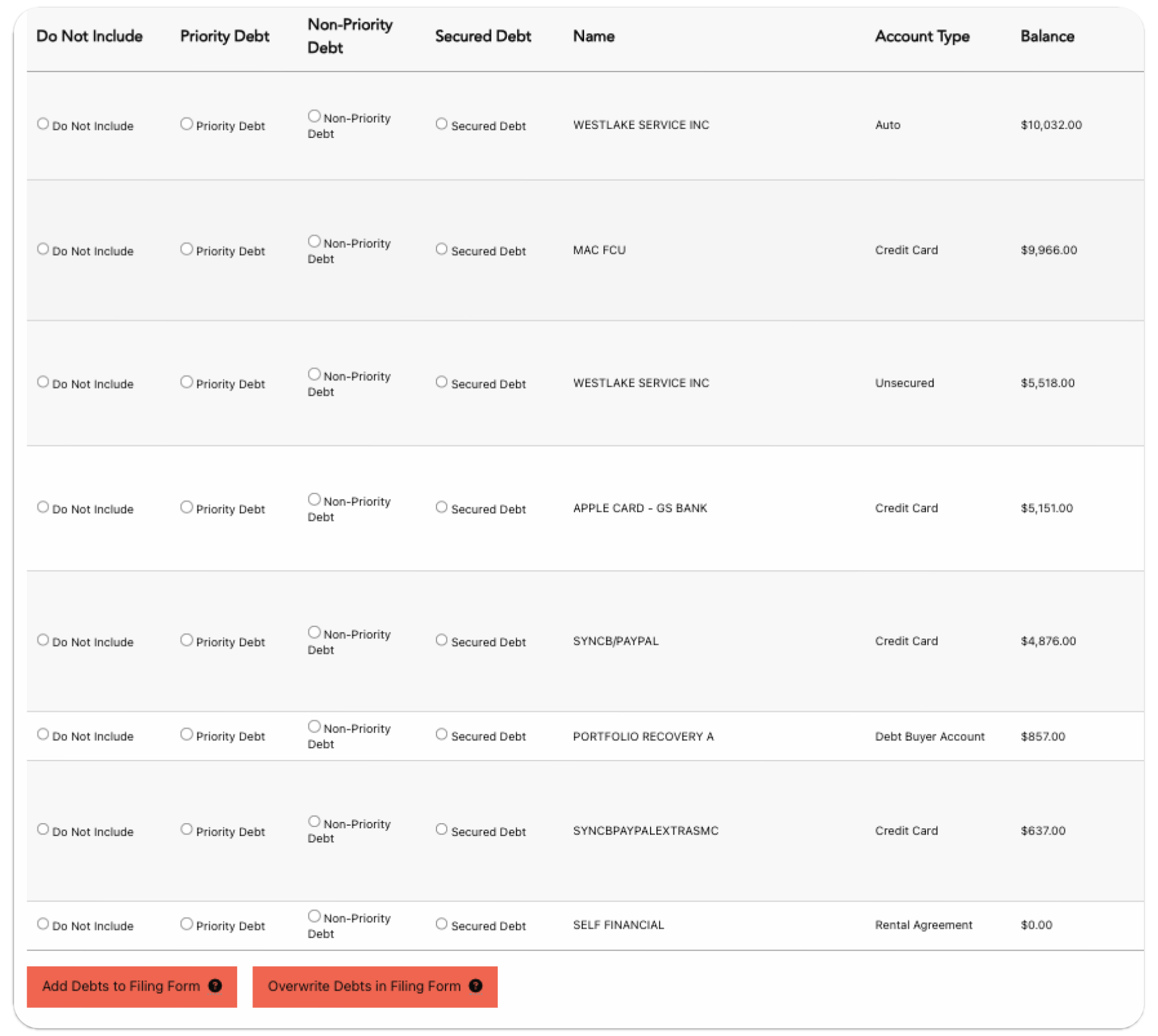

Save hours with a soft credit pull that automatically fills in your unsecured and secured creditors.

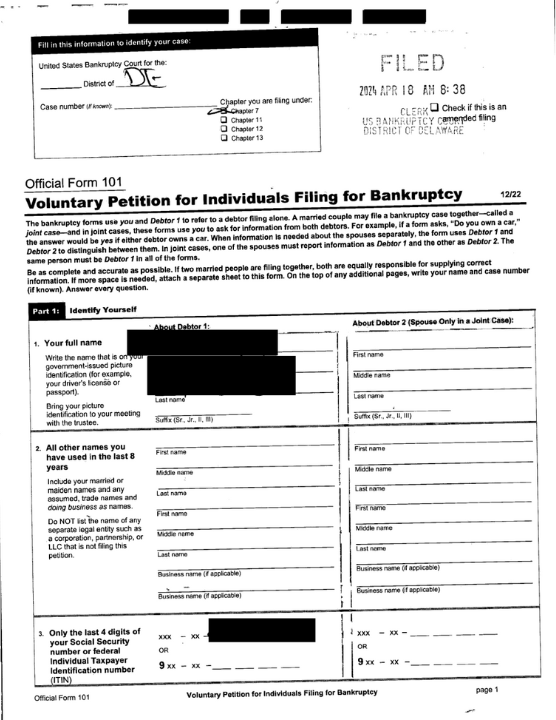

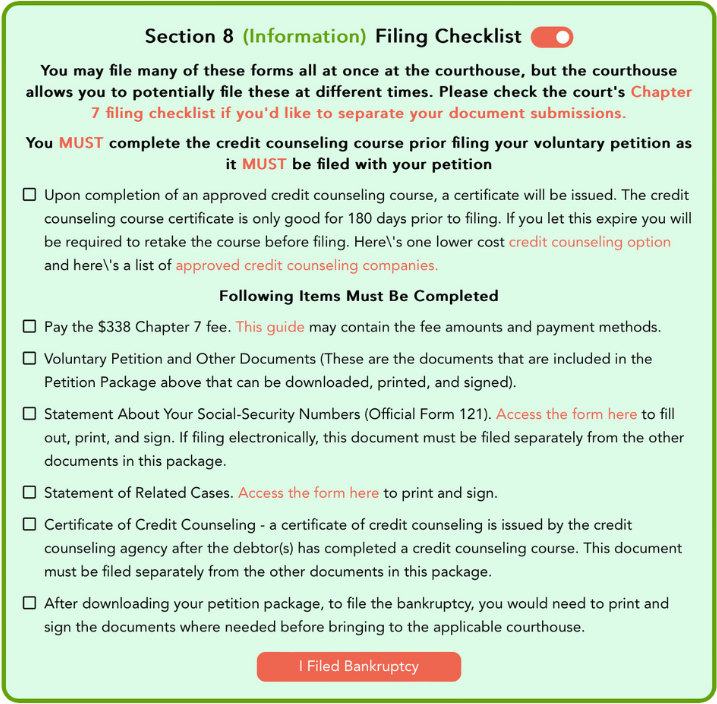

Once forms are completed, download them as PDFs and receive a court checklist with district-specific filing details to streamline your bankruptcy process.

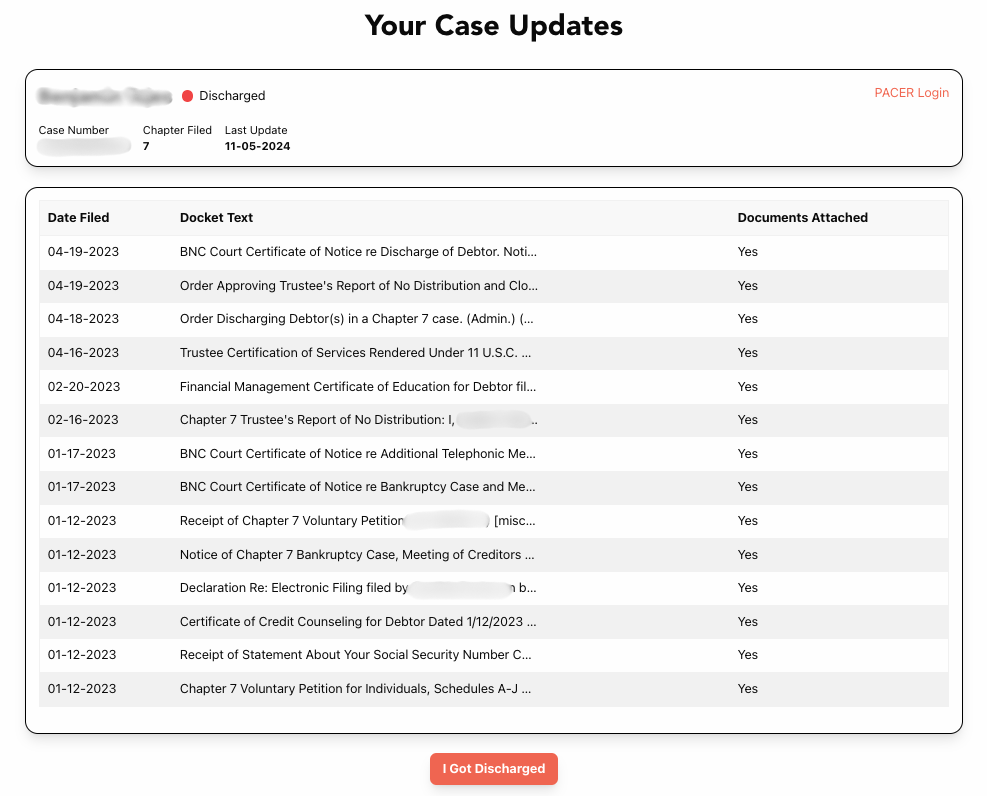

Get automatic updates on your bankruptcy case, including your 341 meeting-- so you're always in the know.